Malaysia Malaysia extends SST deadlines for COVID-19. Please take note that your Final Taxable Period is until 31 August 2018 ONLY and final submission.

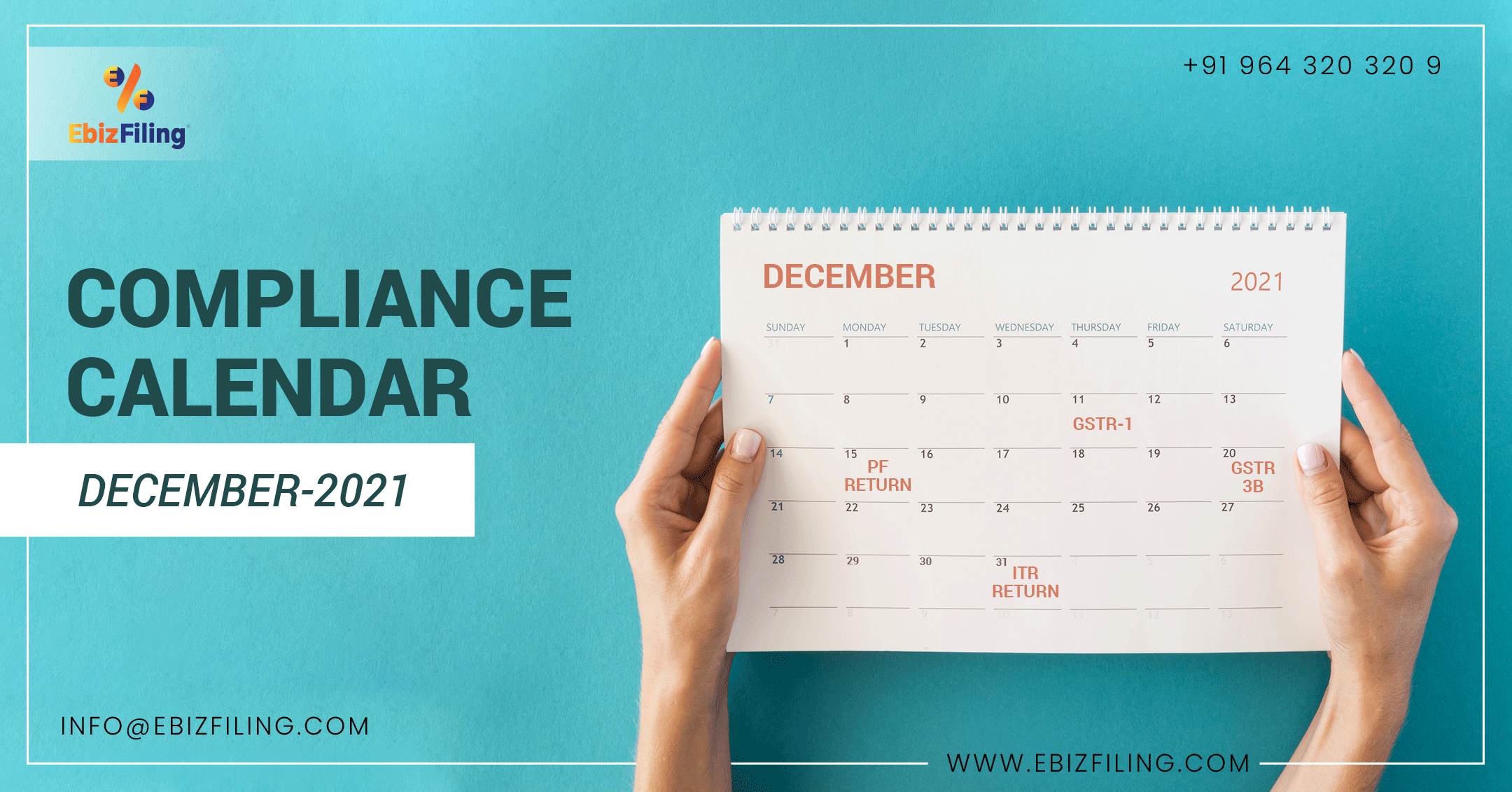

Tax Compliance And Statutory Due Dates For The Month Of December 2021

Both GST returns and payment are due one month after the end of the accounting period covered by the return.

. Tax Estimation Advance Payment. GST a broad-based tax was levied at six per cent on most supplies of goods and services consumed within Malaysia. Example if the taxable period is January to March then the deadline for filing and GST payment shall be 30 April.

Please note that payments are due on the same deadline and it can be paid via bank transfer. Adalah dimaklumkan bahawa Portal MyGST ini tidak lagi dikemaskini semenjak GST dimansuhkan pada 31 Ogos 2018. 1003041 Block J Jaya One No.

Only businesses registered under GST can charge and collect GST. Date of online submission may subject to change. EVEN FYE Months 1st First Taxable Period 2 month 1st Taxable Period 1st September to 31st October 2018 Two months 2nd Taxable Period 1st November to 31st December 2018 Two months and so on.

SST-02 SST-02A Return Manual Submission More 51 28102020 Sales Tax Service Tax Guide on Return Payment More 52 14102020. Deadline for filing of the GST Returns and payment of GST is the last day of the month following the taxable period. More 40.

If you are on GIRO plan for GST payment GIRO deductions are on the 15th day of the month after the payment due date. Income tax return for individual with business income income other than employment income Deadline. The Royal Malaysian Customs Department Customs had previously issued the following Guides on matters relating to GST adjustments and declarations after 1 September 2018.

Audit Assurance and Taxation Services in Malaysia. Input tax credit mechanism. Tax payable under an assessment upon submission of a tax return is due and payable by the last day of the seventh month from the date of closing of accounts.

Different rules apply to most listed financial institutions that file annual returns and to all selected listed financial institutions. Importation of goods is also subject to GST at standard-rated 0. Filing can be done either by post or online.

That means any GST return is due within 30 days of the end of the reporting period. What does the MOF statement dated 16 May 2018 relate to the imposition of GST at 0 and its impact on GST. 30042022 15052022 for e-filing 5.

Corporate income tax CIT due dates. Jabatan Kastam Diraja Malaysia Kompleks. Tax cascading means the tax is added on when the goods move through each stage of the.

Employment income e-BE on or before 15 th May. The procedure however is subject to information given in ITRF as well as the submission of supporting. Malaysias goods and services tax GST was repealed on 31 August 2018 and a new sales tax and service tax SST applies as from 1 September 2018.

The deadline for GST filing GST Returns and payment of GST is the last day of the month following the taxable period. SST on the other hand has a cascading effect. Personal income tax PIT due dates.

Value-added tax VAT rates. PwC Malaysia 60 3 2173 1469. Within 90 working days after manual submission.

All GST Registrants are required to submit the GST-03 Return on the final taxable period and make full payment for the amount of tax payable in connection with the supply for the last taxable period within 120 days from 01092018 to 29122018. GST Guide on Declaration and Adjustment After 1 September 2018. You may refer to your acknowledgement page for payment details after you have filed.

All supplies of goods and services which are now subject to GST at standard-rated 6 becomes standard-rated 0 effective on 01 June 2018. Employment income BE Form on or before 30 th April. The Malaysian Customs Agency has prolonged the filing and payment deadlines for Sales and Services Taxes as the coronavirus crisis continues to affect the economy.

Income tax return for partnership. Business income e-B on or before 15 th July. Due date for filing and payment.

The Government has announced an extension of two months for filing income tax from the original deadline in consideration of the Movement Restriction Order MRO that has been enforced during the COVID-19 pandemic. Segala maklumat sedia ada adalah untuk rujukan sahaja. Businesses have to charge and collect GST on all taxable goods and services supplied to the consumers.

GST was introduced in Malaysia on 1 April 2015 and replaced the Sales and Service Tax SST. Malaysia extends SST deadlines for COVID-19. The Malaysian Inland Revenue Board MIRB has set out a new timetable for certain personal tax filing and employer compliance obligations including due date extensions in light of the COVID-19 crisis.

30062022 15072022 for e-filing 6. For more information about payment deadlines for annual filers see Remit pay the GSTHST instalments. The Goods and Services Tax GST is an abolished value-added tax in Malaysia.

More 39 09042021 Report To Be Prepared For Exemption under AMES. Also the MIRB has closed all its office premises until 14 April 2020. It is uncertain whether the RMCD will require the submission.

Remisi Penalti GagalLewat Bayar Dibawah Akta GST 2014. Sehubungan dengan itu sebarang pertanyaan dan maklumat lanjut berkaitan GST sila hubungi Pusat Panggilan Kastam 1-300-888-500 atau emailkan ke ccccustomsgovmy. GST Guide on Tax Invoice Debit Note Credit Note and Retention Payment After 1 September 2018.

Such a mechanism is particularly needed for transactions occurring after 29 December deadline for filing the final GST return. Businesses are allowed to claim whatever amount of GST paid on the business inputs by offsetting against the output tax. Penalty on Late Payment.

For further information kindly refer the Return Form RF Program on the. Personal income tax PIT rates. Malaysia Various Tax Deadlines Extended Due.

Within 30 working days after e-Filing submission. May to June 2021 quarter has been moved from July 31 to August 31. The new deadline for filing income tax returns in Malaysia is now 30 June 2020 for resident individuals who do not carry on a.

The existing standard rate for GST effective from 1 April 2015 is 6. Business income B Form on or before 30 th June. Income tax return for individual who only received employment income.

GST is levied on most transactions in the production process but is refunded with exception of Blocked Input Tax to all parties in the chain of production other than the final consumer. The IRBM Clients Charter sets that tax refund will be processed.

Malaysia Sst Sales And Service Tax A Complete Guide

Tax Compliance And Statutory Due Dates For April 2022 Ebizfiling

Gst Returns In 2018 Due Dates Requirements And Penalties

Gst Submission Deadline Malaysia Madalynngwf

Tax Compliance And Statutory Due Dates For The Month Of July 2021

Filing Of Gst Return Video Guide Youtube

Extension Of Deadlines For Submission Payment Under Mco 18 03 2020 28 04 2020

𝗧𝗮𝘅 𝗳𝗶𝗹𝗶𝗻𝗴 𝗗𝗲𝗮𝗱𝗹𝗶𝗻𝗲𝘀 𝗳𝗼𝗿 𝟮𝟬𝟮𝟭 Ks Chia Associates Facebook

Malaysia Amendment To Final Gst Return Kpmg United States

Tax Compliance Statutory Due Dates For May 2022 Ebizfiling

Matching And Reconciliation Under Gst Enterslice

Gst Return Filing Deadlines The Three Month Storm

An Overview Of Gst Return Under Composition Scheme Enterslice

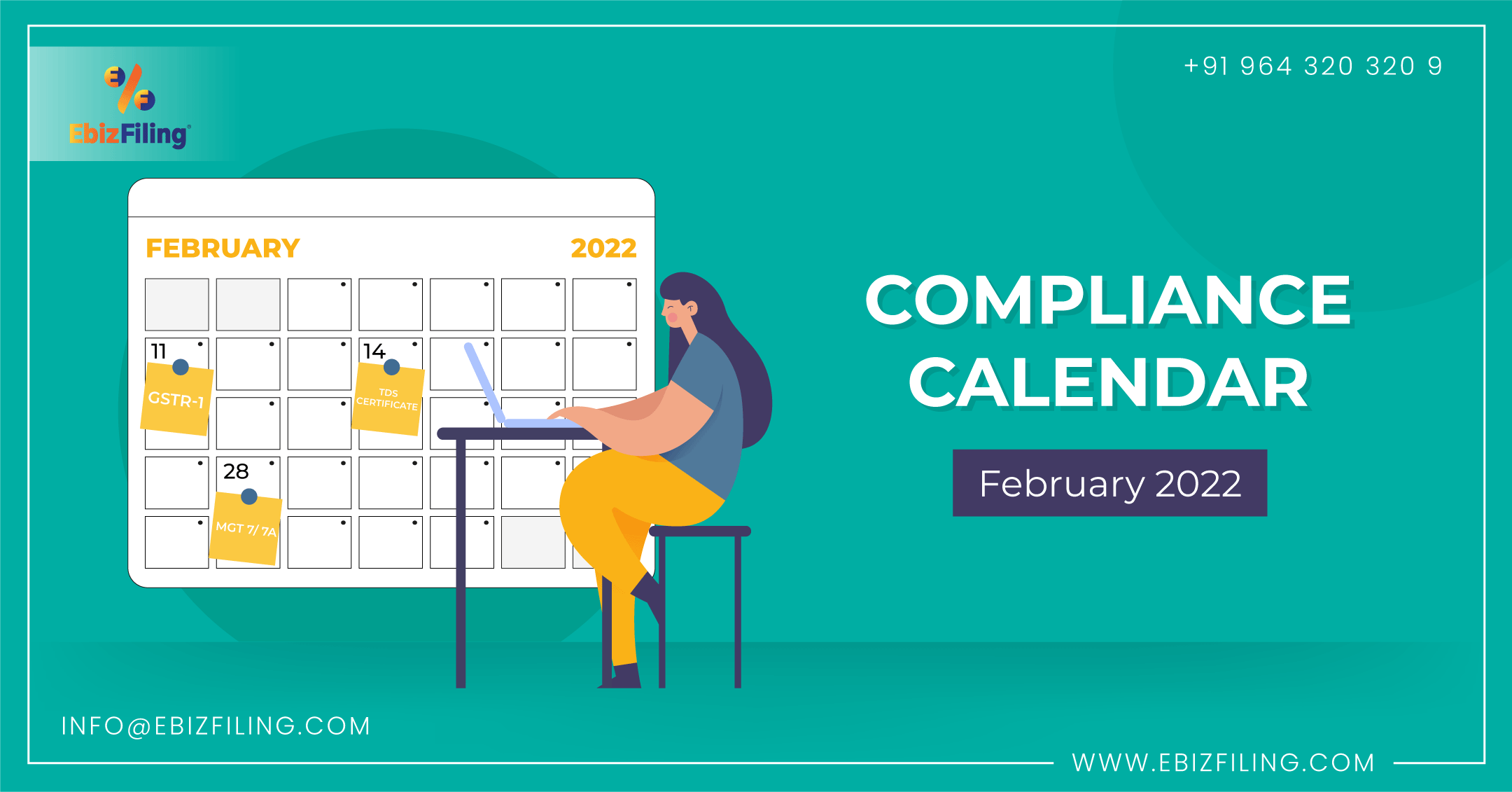

Tax Compliance And Statutory Due Dates For February 2022 Ebizfiling

Tax Compliance And Statutory Due Dates For The Month Of November 2021

Malaysia Amendment To Final Gst Return Kpmg United States

Preparing Vat Returns And Gst Returns Xero Blog

Gst Return Filing Deadlines The Three Month Storm