EPF is an retirement investment plan opted by a number of employees as this has number of benefits. The review of the EPF interest rate for a financial year is set at the end of the financial year.

Kwsp Epf Sets Rm228 000 As Minimum Target Savings At Age 55

Employee usually contributes 12 of their basic pay and employer.

. The Company and employee both contribute near about 12 of the basic salary of the employee. 3 Organisation Employees Provident Fund Organization EPFO. 25 lakh by an employee to a recognized provident fund is taxable.

If the EPS contribution was 833 of full basic da for all those 20 years the total contribution to EPS 1652 Lakh. EPF has the main yojana under the Employees Provident Fund and Miscellaneous Act 1952. The Employees Provident Fund is a scheme that helps individuals save towards their retirement.

Also it is a low-risk instrument due to government backing offers a pension and is a very convenient saving tool. And also dearness allowance concerning EPF. An individual who joined the Employees Provident Fund scheme after September 1 2014 cannot open an Employees Pension Scheme account if hisher monthly salary exceeds Rs 15000This is because the government amended the rules related to EPF and EPS schemes via a notification dated August 22 2014 which became effective from September 1 2014.

The answer is yes you can. Lets use this latest EPF rate for our example. Changes How to file.

We are all aware that Budget 2021 The Finance Bill 2021 has introduced one of the key amendments to the EPF Act. Without AADHAAR number like in my AADHAR BOX. Now you can link Aadhaar to EPF Online without login.

As of now the EPF interest rate is 850 FY 2019-20. But this rate is revised every year. When the EPFO announces the interest rate for a fiscal year and the year closes the interest rate is computed for the month-by-month closing balance and then for the entire year.

EPF is an excellent saving scheme. The interest offered on VPF is as per with the EPF scheme and the interest earned is credited to their EPF account. VPF Interest Rate 2019-20.

Standard Employer EPF Rate is 13 if the Salary is less than RM5000 while 12 if the Salary is more than RM5000. The employee can contribute a full amount of their basic salary as well as DA. Through the EPF account money-saving has been done.

As per this amendment from 1st April 2021 onwards the interest on any contribution above Rs. Now the deduction towards EPF has to be 12 of your basic salary as per the laws. Income Tax for FY 2019-20 or AY 2020-21.

NOT available Verified demographic but if i click basic details it shows My AADHAAR number and status shows as Accepted by mumbai Field Office OK. Since 2020 the default. Until FY 2020-21 the interest income earned on contributions to EPF made by the.

Employees Provident Fund is a retirement investment plan that every salaried individual opts for. Can an employee contribute more than 12 of basic salary towards EPF. The Pension Scheme 1995.

So its necessary to get serious about saving for your retirement before its too late. The EPFO has decided to provide 850 percent interest rate on EPF deposits for 2019-20 in the Central Board of Trustees CBT meeting held today states Gangwar. Employees State Insurance Act 1948 Extends to Whole INDIA Whole India 2 Name of Scheme Employees Provident Fund Scheme.

EPFO Pension Apply Online 2022. How to calculate Tax on EPF Interest. The employees who fall under the EPF scheme make a fixed contribution of 12 of the basic salary and the dearness allowance towards the scheme.

The EPF Scheme 1952. As mentioned earlier interest on EPF is calculated monthly. Hello Sir I have modified my Basic details through UAN Login as on 080819 and twice visited to EPF regional office at Vashi in September month to the Accounts Department to authenticate.

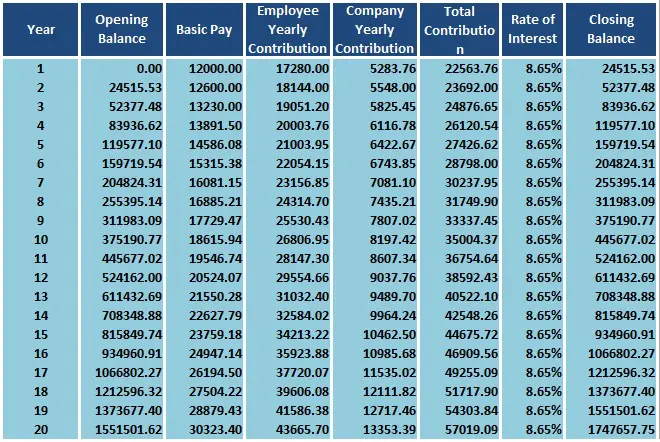

For the financial year 2021 the Employee Provident Fund interest rate is set at. The Central Board of Trustee is considered as the apex decision-making body of Employees Provident Fund Organization. Assume that you the employee in this case joined the job exactly on 1 st April 2018.

EPF Interest Rates 2022 2022. Various benefits of the scheme can be availed by employees. 2019 at 1117 AM.

The last declared EPF interest rate was for the year 2019-20 which stood at 850. If you are interested to know the calculation of the EPF contribution formula you have came to the right place. Employees State Insurance Corporation.

The Employees Provident Fund Organisation operates three schemes. Employees Provident Fund Organisation EPFO is the largest social security organization of India. Basis EPF ESI 1 Acts Applicable The Employees Provident Funds And Miscellaneous Provident Act 1952.

Contribution 12 of the employees basic salary towards the scheme is made by the employer and employee each. The EPF scheme is handled by the Employees Provident Fund Organisation. The employer should also make an equal contribution to the EPF.

EPF Form 11 is a declaration form which has to be submitted by an employee when taking up new employment in an organization which offers EPF Scheme Employees Provident FundThis form contains basic information regarding the employee like name date of birth contact details previous employment details KYC Aadhar Bank account PAN etc. It was formed by the Government of India. Earlier you have to log in to the Unified portal to link Aadhaar to EPF online.

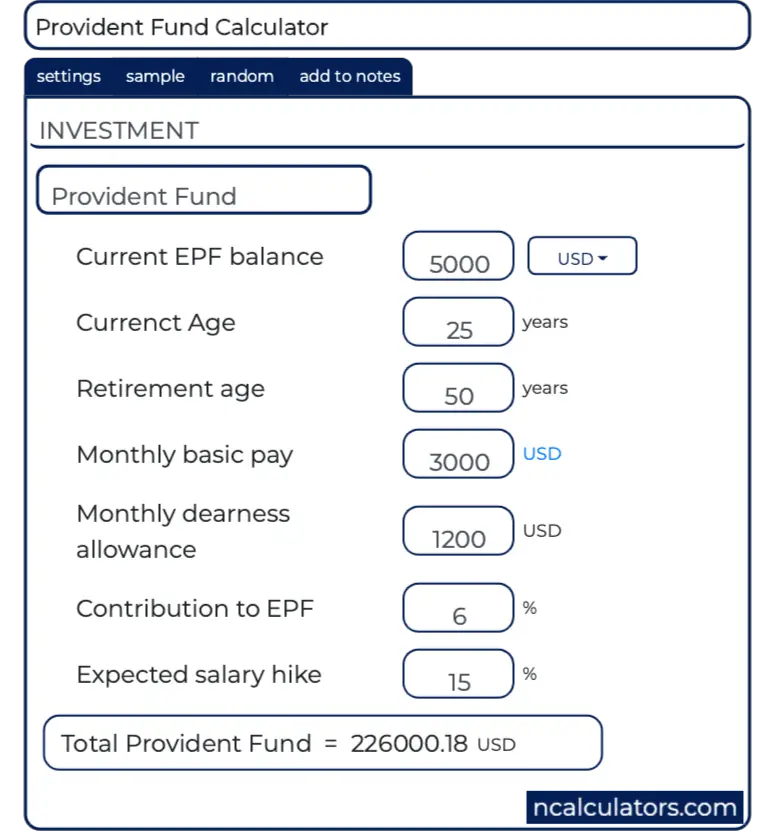

This is the basic workings of an EPF scheme. The Insurance Scheme 1976. The rate at which salary basic DA alone will increase each year 5.

The interest rate on EPF is reviewed on a yearly basis. So your and your employer. This privilege is only for the first three years of employment.

EPF Interest Rate. EPF Pension Registration Form. In the event you are looking for ERP system with an affordable HR Payroll read this HR Payroll for Malaysia.

Years in service 20. So the EPF interest rate applicable per month is 86512 07083. If the EPS contribution was fixed at 15000 a year the total contribution over 20 years 3 Lakh.

In the union budget 2018-2019 new women employees can make an EPF contribution of 8 instead of 12. An employee can contribute an additional amount over the 12 of basic salary in EPF. The EPF interest rate for FY 2018-2019 is 865.

The Employees Provident Fund Organization EPFO Central Board of Trustees after consultation with the Ministry of Finance reviews the EPF interest rates every year. The EPF interest rate for the fiscal year 2022-23 is 810. ITR for FY 2018-19 or AY 2019-20.

Employees Provident Fund EPF is a retirement benefits scheme where the employee contributes 12 of his basic salary and dearness allowance every month.

Epf Withdrawal Education Finance Tips How To Apply

Epf New Basic Savings Changes 2019 Mypf My

Epf Vpf Historical Interest Rate Interest Rates Rate Historical

Conversion Of Partnership Firm To Llp Taxovita Com Private Limited Company Public Limited Company Limited Liability Partnership

Why Should You Withdraw Old Epf Account Balance In Operative Epf A C Timeline In 2021 Investment In India Personal Finance Accounting

Epf Calculator Deals 40 Off Www Otsv De

Epf Announces 5 2 Dividend For Conventional Accounts 4 9 For Shariah Free Malaysia Today Fmt In 2021 Dividend Accounting Free Online

Average Savings Of Epf Members At 54 Years Of Age Download Table

Labour Ministry Notifies 8 65 Interest Rate On Epf For 2018 19 Interest Rates Growing Wealth Personal Finance

Epf Calculator Deals 40 Off Www Otsv De

How To Do Epf E Nomination With Beneficiary Aadhaar Photo Investment In India News Online Stock Market Investing

Pin By Chin Eu On Epf Kwap Ltat Lth Pnb Ptptn Investing Periodic Table Estimate

How Social Security Code 2019 Will Impact Employees Gratuity Protect Their Epf Dues Savings And Investment Investing For Retirement Savings Strategy

Epf New Basic Savings Changes 2019 Mypf My

Epf Dividend Table 2019 Dividend Life Insurance Policy Financial Instrument

Average Savings Of Epf Members At 54 Years Of Age Download Table

Look Beyond Epf For Retirement The Star